In an era marked by unprecedented global tax cooperation and reform, the question remains: have we truly achieved the mission of a fair and transparent international tax system? As nations continue to implement sweeping changes from BEPS to digital economy taxation, this theme explores the successes, challenges, and future direction of International tax reforms. Taxsutra Conclave 2024 will bring together thought leaders and experts to assess the milestones achieved, the gaps that persist, and what lies ahead in shaping a robust global tax framework.

Hear from tax policy-makers, tax experts & tax administrators

Thought leadership on carefully designed technical subject panels

Interact with 250 Tax Heads & CFOs

1. Tax Policy and Reform ► Recent Changes: Overview of recent tax policy changes in major jurisdictions. ► Impact Assessment: Analysis of how these changes affect businesses and international tax planning. ► Future Trends: Predictions and discussions on upcoming reforms and their potential impact. ► Global Coordination: Efforts to harmonize tax policies internationally and the […]

TAXSUTRA CONCLAVE 2024 : INTERNATIONAL TAX REFORMS – MISSION ACCOMPLISHED? In an era marked by unprecedented global tax cooperation and reform, the question remains: have we truly achieved the mission of a fair and transparent international tax system? As nations continue to implement sweeping changes from BEPS to digital economy taxation, this theme explores the […]

Registrations and Tea / Coffee

Welcome Address

Fireside Chat with Mr. P. R. Ramesh (Independent Director) on Latest Corporate Governance & Regulatory Trends

Panel 1 – International Tax Policy and Reform

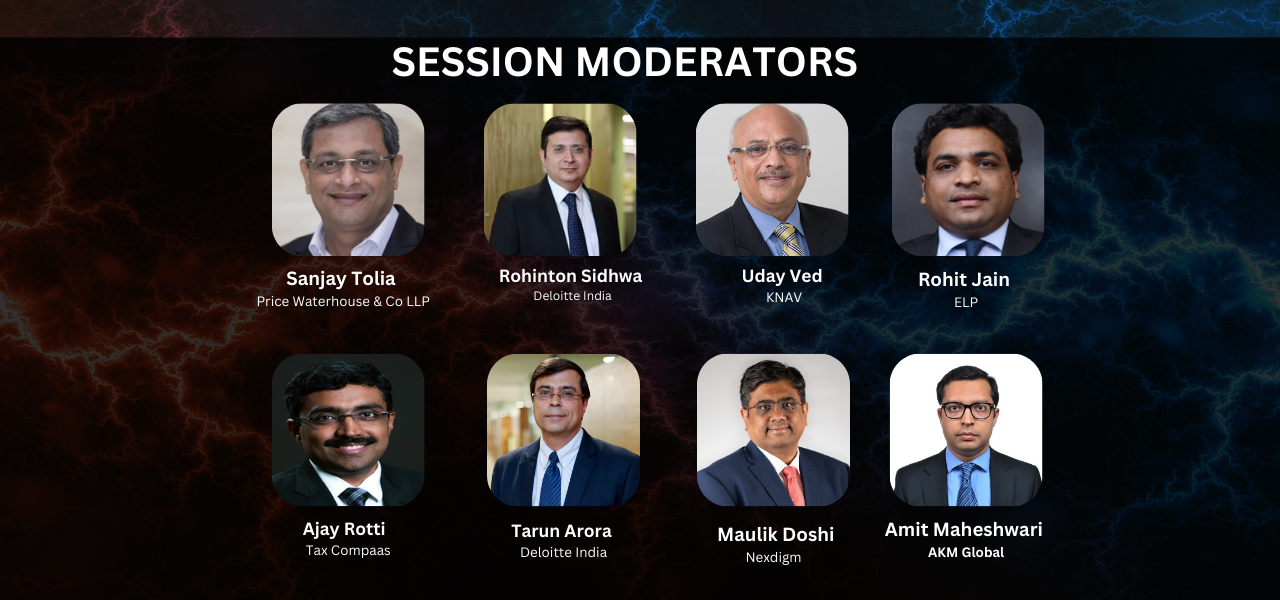

Moderator – Mr. Rohinton Sidhwa (Deloitte India)

Panelists –

Mr. Pascal Saint-Amans (Partner, Brunswick Group & Former Director, Centre for Tax Policy and Administration, OECD)

Mr. Navin Jain (Head Taxation – South Asia, Hindustan Unilever Limited)

Mr. Ashutosh Dikshit (Deloitte India)

Tea / Coffee Break

Address – Litigation, Assessment and Powers of Authority : Lessons from Apex Court

Speaker – Mr. L. Badri Narayanan (Lakshmikumaran & Sridharan, Attorneys (LKS))

Panel 2 – Cross-Border Investments and Structuring

Moderator – Mr. Amit Maheshwari (AKM Global)

Panelists-

Mr. Mahendra Lodha (CFO – Bloomsbury Publishing India Pvt. Ltd.)

Mr. Simachal Mohanty (Head – Global Taxation, Dr. Reddy’s Laboratories)

Mr. Rahul Barve (Executive Vice President – Head Taxation, Zee Entertainment Enterprises Ltd)

Mr. Sandeep Sehgal (AKM Global)

Lunch

Panel 3 – Corporate Taxation in a post-BEPS World

Moderator – Mr. Jitendra Jain (Price Waterhouse & Co LLP)

Panelists –

Mr. Akhilesh Ranjan (Advisor, Price Waterhouse & Co LLP and Former member of CBDT)

Mr. Pascal Saint-Amans (Partner, Brunswick Group & Former Director, Centre for Tax Policy and Administration, OECD)

Ms. Vijayashree Ranganathan (Head- Taxation, VFS Global)

Mr. Piyush Gupta (Sr. Director – Tax, India and APAC, Concentrix)

Panel 4 – Tax Disputes and Litigation

Moderator – Mr. Rohit Jain (Economic Laws Practice (ELP))

Panelists –

Mr. Mohd Haroon Qureshi (SVP and Head of Tax – Asia Pacific, Genpact)

Mr. Vineet Agrawal (Senior Executive Vice President and Group Head -Taxation & Ethics, JSW Group)

Tea / Coffee Break

Digital Economy Taxation: Journey So Far and the Path Forward

Speaker – Mr. Yogesh Thar (Bansi S. Mehta & Co.)

Panel 5 – Litigation Playbook: Senior Counsels’ Perspective

Moderator – Mr. Mukesh Butani (BMR Legal)

Panelists –

Mr. Porus Kaka (Senior Advocate)

Mr. Balbir Singh (Senior Advocate)

Mr. Rohan Shah (Senior Advocate)

Panel 6 – Economic Offences, Tax Writs and Reassessments: Latest Jurisprudence

Moderator – Mr. Sagar Tilak (Advocate)

Panelists –

Mr. Sachit Jolly (Advocate)

Mr. Zoheb Hossain (Special Counsel – Income-tax Department & Enforcement Directorate)

Cocktails Reception

Registration and Breakfast

Breakfast Session – Increasing Relevance of Anti-corruption Laws for CFOs and Tax Managers

Speaker – Mr. Nishant Shah (Economic Laws Practice (ELP))

Fireside Chat with Senior Advocate N. Venkataraman (Additional Solicitor General of India) and Senior Advocate Ajay Vohra moderated by Mr. Ajay Rotti (Tax Compaas)

Panel 7 – International Tax Developments in India

Moderator – Mr. Maulik Doshi (Nexdigm)

Panelists –

Mr. Vijay Pandya (Global Tax Head, Tata Consultancy Services Limited)

Mr. Romesh Sankhe (Vice President – Finance (Direct Tax), Vodafone Idea Limited)

Mr. Vaibhav Mangal (Associate Director Taxation for India and MEA, Perfetti India)

Mr. Arun Ramachandran (Vice President – Tax, Genpact)

Special Address – Challenges & Innovations in International Taxation

Speaker – Mr. Dinesh Kanabar (Dhruva Advisors LLP)

Tea/Coffee Break

Sealing the Deal – 5 Critical Tax Factors for U.S. Business Acquisitions

Speaker – Mr. Shishir Lagu (KNAV)

Panel 8 – From Uncertainty to Strategy: Transforming Tax Decisions in the Uncertain GST Era

Moderator – Mr. Shivam Mehta (Lakshmikumaran & Sridharan, Attorneys (LKS))

Panelists –

Mr. Madhur Sharma (CFO – India & Bangladesh, Louis Dreyfus Company)

Mr. Aditya Gupta (India Tax Lead, Mondelēz International)

Mr. Arun Gulati (Senior Manager – Customs and Indirect Taxes, BMW India)

Mr. Karanjot Singh (Lakshmikumaran & Sridharan, Attorneys (LKS))

Lunch

Address – M&A: Recent Trends

Speaker – Mr. Girish Vanvari (Transaction Square)

Achieving Tax Certainty in India

Speakers–

Mr. Tarun Arora (Deloitte India)

Mr. Sobhan Kar (Deloitte India)

Tea/Coffee Break

Panel 9 – Changing Dynamics of Treaty Interpretation and Entitlement

Moderator – Mr. Sachin Sastakar (Chartered Accountant)

Panelists –

Mr. Pramod Kumar (Former Vice-President, ITAT)

Mr. Dali Bouzoraa (President, Tax Research & Planning, ORBITAX)

Mr. K. R. Sekar (Chartered Accountant)

Ms. Anjali Agrawal (Bansi S. Mehta & Co.)

Workshop Session 1: Privacy Aspects in Digital Auditing and Digital Personal Data Protection

Speaker – Mr. K. Vaitheeswaran (Advocate)

Workshop Session 2: Deeming Fictions in Domestic Law and Effects on Tax Treaties

Speaker – Dr. Dhruv Janssen-Sanghavi (Janssen-Sanghavi & Associates)

The beautiful setting of the Oberoi at Gurgaon in the NCR region – vote das the World’s leading luxury hotel in 2013, shall serve as the backdrop as we welcome eminent Indian and international speakers and 250 corporate tax heads & CFOs.

The Taxsutra Conclave aims to see the participation of 250 Tax Heads and CFOs, who shall be extended complimentary-delegate passes. CFOs & Tax Head of Corporates can send their request Email.

From their official email address with the following details: Name, company name, designation, mobile number and your official email ID. You shall receive a confirmation mail from Taxsutra team.

Advisors, Counsel, Consultants, other Executives and all those in Private Practice can also attend.